US Consumers have certainly taken notice of the gravity of the situation and changed attitudes and behaviors accordingly.

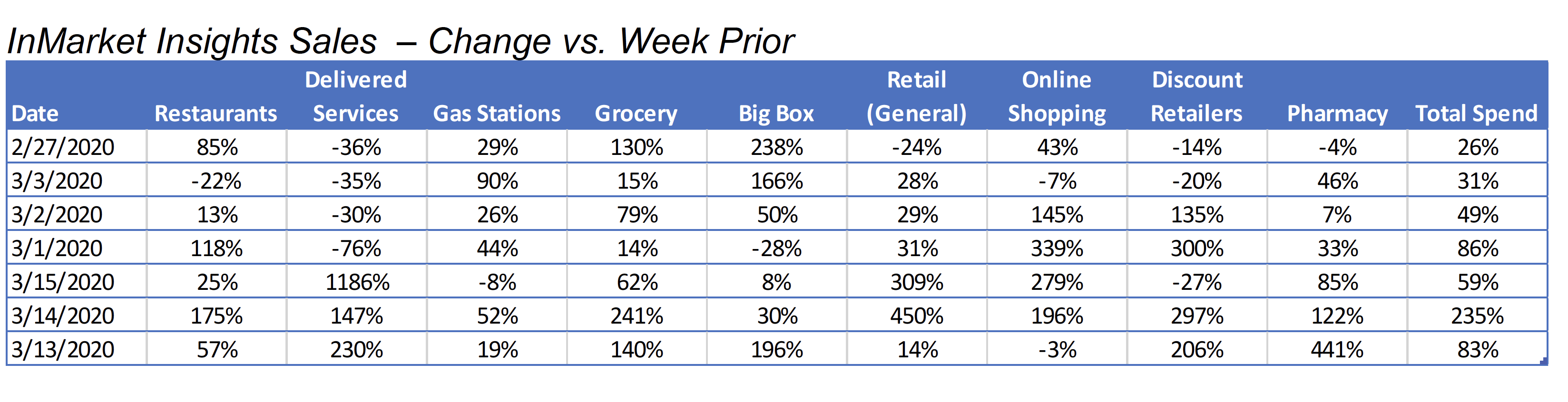

The first major increase in credit card spending (a 26% increase over the week prior) happened on February 27th, the day of US confirmed its first case of unknown transmission, driven by a 130% increase in Grocery and a 238% in Big Box spending.

On March 1st Governor Ron Desantis declared a public health emergency in the state of Florida, followed shortly by Kentucky, New York, Maryland, Utah and Oregon. This resulted in a 3-day double-digit increase in consumer spending over the week prior.

When President Trump declared a national state of emergency on March 13th, an even larger bump in 3-day spending was noted. There was a 235% increase on March 14th driven heavily by General Retail, Discount Retail, and Grocery, as the most current round of panic buying began. March 15th saw a 1,185% spike in Delivered Services driven by a 279% jump in Online Shopping.

Demand for cleaners/disinfectants, hand soaps/sanitizers, and other cleaning staples have increased. People will continue to stockpile groceries, eat out less, and increase online shopping/home delivery. As the situation evolves, companies will need to monitor these trends and identify areas of opportunity.

Areas of opportunity for the grocery industry may include:

Shelf-stable foods

a. Products that are shelf-stable/ling lived are in high demand as consumers anticipate state or self-imposed quarantines

b. Interest in fresh/artisanal foods is being tested as consumers opt for easy to store, preserved products

c. Brands that make protecting or preventing disasters simple and easy will appeal to customers, particularly those with a high propensity for preparing for the worse

d. The shelf-stable trend also opens the door for products consumers have been trending away from, such as canned or processed foods, to gain new life because of their longevity

Brands and retail outlets have an opportunity to connect more deeply with consumers through shelf-stable foods

a. Consumers may be stockpiling shelf stable foods, but they may not fully understand how to use/prepare them

b. Brands may have an opportunity to connect with consumers through content explaining how shelf stable foods can be prepared, even integrated into a healthy, gourmet lifestyle

Home storage is at a premium

a. As consumers stockpile goods, home storage will become a concern

b. Individually wrapped (and thus, “stay-fresh”) single-serve products such as tinned fish packets, dried cheese bars, of single serve nut butters may serve as smart-storage solutions

c. Condensed products, dried goods, and contemporary bullion cubes are also potential opportunities

Packaging may also emerge as an area of interest

a. USDA’s Food Safety and Inspection Service currently has no reports that the COVID-19 virus can be transmitted by food or food packaging, and the absence of packaging could actually pose a problem in the short term

b. As consumers are reminded to use caution when touching anything, he suggests that the popularity of in-store refill systems and refill packaging may be in jeopardy

c. With a return to single-use cups there and in other foodservice outlets, this spells demand and a current opportunity for paper, plastic and other single-use cups, plates and utensils

Immunity support may be a driver of sales

a. Knowing that the elderly, those with pre-existing health conditions and the immune-compromised face the highest risk for complications, interest in products that boost immune response may surge

b. Immunity support has been a focus for some consumers, but this may be the time for manufacturers to reinforce its importance and widen that audience

A growth in online shopping is inevitable

a. In the US, as of early March, 8% of consumers report having increased their online shopping

b. With media reports of empty shelves and delayed Amazon deliveries, this trend is expected to grow

c. This is an opportunity for companies to connect with their consumers through online content and to innovate new and exciting ways to allow the online shopping experience to shine

Retailers will have both a challenge and an opportunity to serve existing customers and win potentially new customers

a. Retailers also have an opportunity to introduce themselves to a new group of shoppers who may be willing to pay more or shop at an new/unfamiliar retailer (either online or in-person) to find an item that is out of stock at their usual shopping venue.

Over-communicate with your customers to keep them reassured and informed

a. Leverage social media platforms to re-engage with shoppers and drive sales online if necessary

b. Livestream to drive sales both online and in-store by showing customers that you are open for business and have the items they need

Mintel COVID-19 in the US: What’s Happening Now

Mintel US Consumers Respond to COVID-19

InMarket: How is COVID-19 Affecting Consumer Shopping Behavior?

Coresite Research: Coronavirus Blog – Insights from Our Analysts