Sports world upheaval

The biggest factor in the TV/Video marketplace at the moment is the impact of the cancellation of the NCAA tournament and the postponement of all other sports such as the NBA, MLB, NHL and Premiere League.

This turns back a reported $1.5B in ad spend back to marketers. Some of that will not return to the marketplace, but much of it will. Samsung, P&G and CPG’s in general are looking to place dollars back in market from the NCAA cancellation, specifically in Primetime where avails prior to all of this were scarce.

At the moment the NCAAs are the only full cancellation, but there is a general consensus that the delays to other sports will be lengthy, and full or partial cancellations are very likely. Most marketers are sitting tight with spending for sports with TBD decisions coming.

Are marketers cutting/cancelling/shifting?

There are clearly some advertiser categories being impacted more directly than others. Those marketers have begun requesting relief in the form of cancellations and shifts to later quarters/months. Specifically, the following categories are the most active in terms of pullback:

Travel/hospitality/Destination: Mostly requesting complete stoppage of all advertising and looking to recoup funds from networks/stations. This category was hit first and hardest by the Covid-19 outbreak.

Retail: There is a bit of a divide between more traditional brick and mortar retail marketers and e-commerce ones. Those that rely heavily on traditional brick and mortar sales are requesting cancellations and shifts out of 1Q/2Q to later quarters. E-commerce retailers, or brick and mortar retailers with strong e-commerce business as well, are maintaining spend for the most part, some looking to switch creative messaging to better fit current business needs.

Studio: Significant cuts and shifts requested as the movie business has been hit hard. Titles will continue to move to later in the year. Disney studios has shifted all short term spend to support Disney+ streaming service so those dollars will remain in market.

QSR/Restaurant: Like retail, QSR/Restaurant marketers are split in terms of who is being impacted the most. Those with significant delivery capabilities are pivoting towards “delivery” messaging and are either maintaining spend or shifting small amounts are delivery messaging is prepared. Those without a delivery option, or a strong delivery option, have requested immediate cancellation of media short term with a wait and see longer-term approach.

Are any marketers looking to add $s:

In addition to the displaced sports money being relocated back into the marketplace there are other categories looking to increase spend. CPG has been cited as an area where, depending on the product, an increase in spending appears to be happening. In the DTC and ecommerce space there are certain marketers looking to increase spend as time spent with TV/Video is on the rise.

Overall the DTC space is mostly taking a wait and see approach, which will lead to a mix of adds and cuts, depending on specific products, down the line. Streamers (ie. Netflix, Amazon, etc) are all inquiring about incremental spend as well, looking to drive subscription and usage while people are primed for usage.

Auto is a category that seems to be standing pat for now. It is a huge category and should there be a move to cut or add, it would have significant ramifications on the overall marketplace. Auto is also a huge sports player, so some decisions will start to follow as more news comes from the various leagues.

Telco has taken a generally cautious approach, with some slight changes in the near term, but no major cuts being made.

What will be the market impact of all these cuts and adds?

Right now, it is a bit too early to tell, as marketers and networks try and assess all of the initial requests. However, the consensus is that inventory over the last few weeks of 2Q, Prime in particular, will not have much in the way of availability, and that will be used up quickly with displaced NCAA $s. Moving into 2Q we expect to see more move/cut requests and a general settling in with the new norm. We would anticipate opportunities might arise in 2Q as ratings increase.

Are ratings going up?

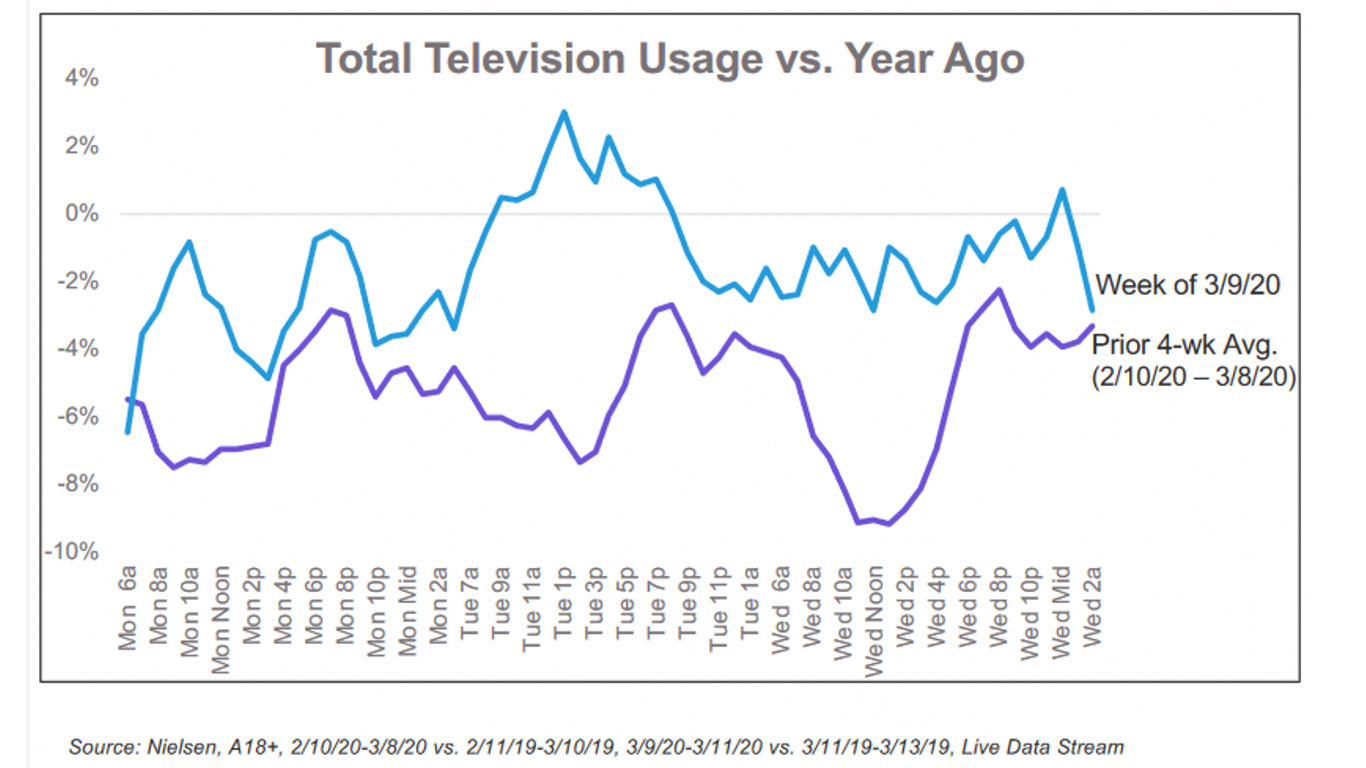

Early signs are that linear tv viewing is up, possibly dramatically. NBC is claiming +25% jump in viewership at the end of last week and they provided this general TV Usage comparison vs. YAG showing significant gains in TV usage vs. same time period last 4 week average.

In addition to Linear ratings growth, the Premium Non-Linear (OTT) space will be the biggest area of opportunity as the expectation is that streaming will be on the rise in the upcoming weeks as well. There is the potential for immediate opportunities is this space.

What else is happening:

Late Night is now starting to see significant programming changes due to the virus. All NY based shows are pausing for the next couple of weeks. Jimmy Fallon, James Corden and Colbert are all going dark. Corden is still TBD, however, due to the tournament, he was already scheduled for repeats in most days over the next 2 weeks. Jimmy Kimmel Live, while originally was planning on airing without an audience just announced he will go on hiatus for the next 2 weeks.

Cable partners are open for scatter business as well and might start to see programming stunts pop up to try to garner more dollars coming from live sports. Prior to this week, cable networks have started to see more success in marketers agreeing to digital or marketing wipes to pay off linear liability which has taken some pressure off linear inventory.

Networks feel mostly confident that they have enough programming “in the can” that there will not be a new programming shortage until 4Q, however, that is a very early “gut check” and are all assessing as we speak.