We all know that the Coronavirus is impacting US advertising, but the questions all of us within the ad industry should be asking is, how and for how long?

Fortunately, the smart folks at the Interactive Advertising Bureau have been researching this and have come up with some interesting statistics.

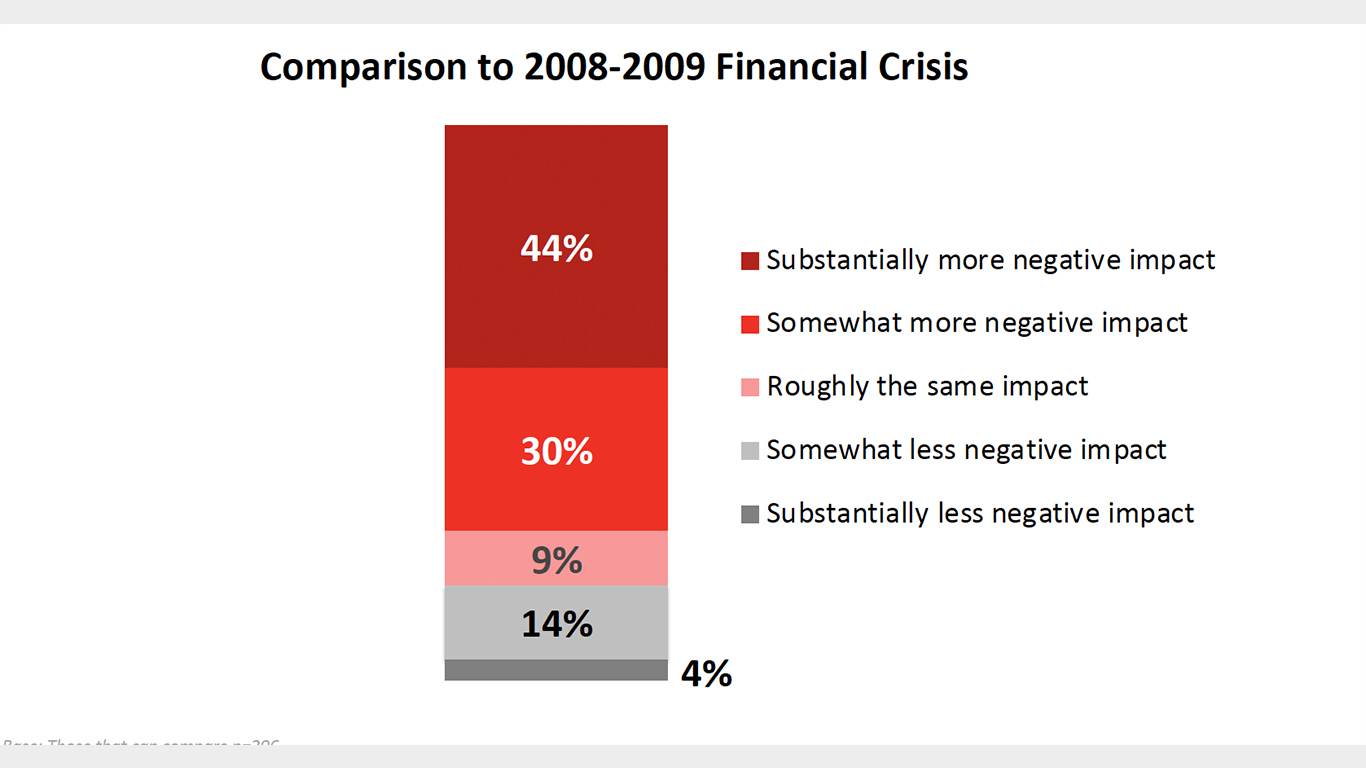

One bottom-line conclusion uncovered from their research is that as of today, 74% of buy-side decision-makers think the Coronavirus will have a greater impact on US ad spend than the 2008-2009 financial crisis.

Other important findings from their research show:

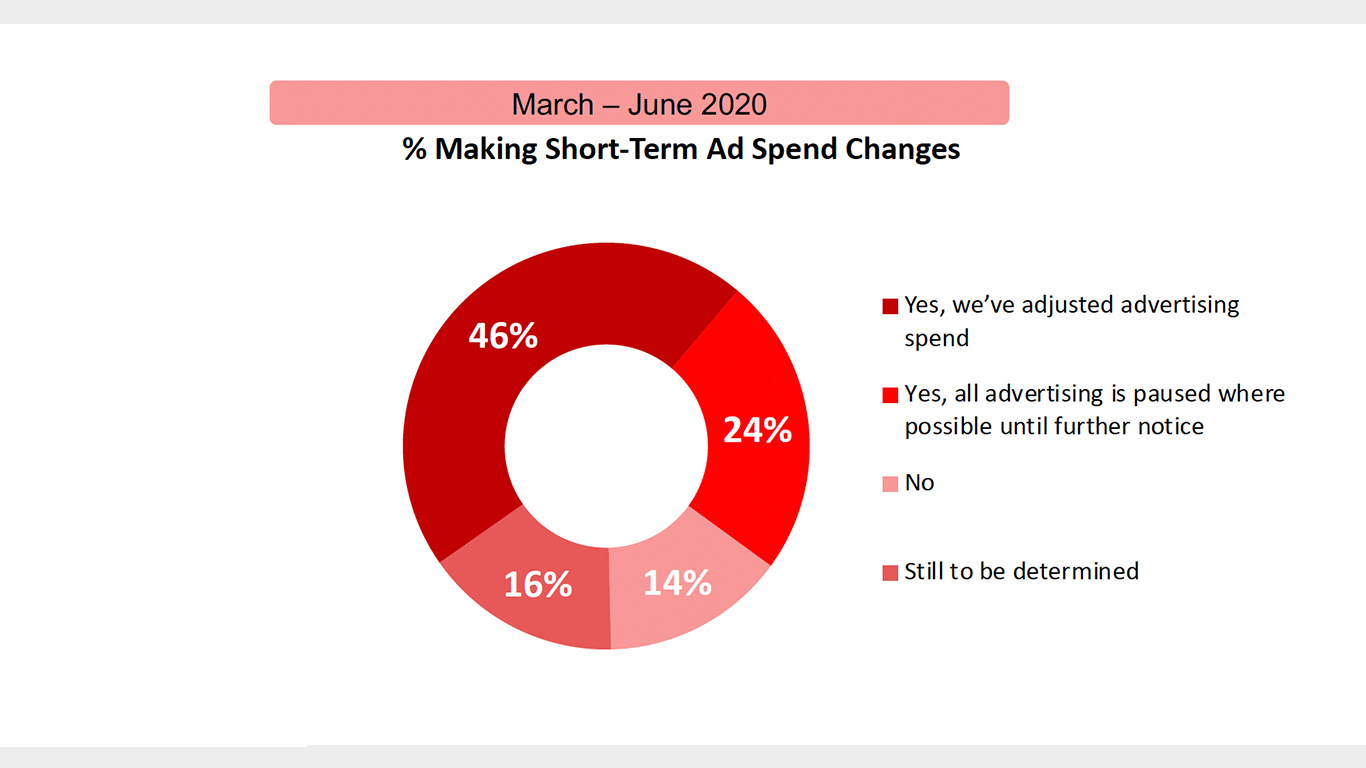

• Nearly a quarter (24%) of respondents have paused all advertising spend for the rest of Q1 & Q2

• Another 46% of respondents are adjusting advertising spend for the rest of Q1 & Q2

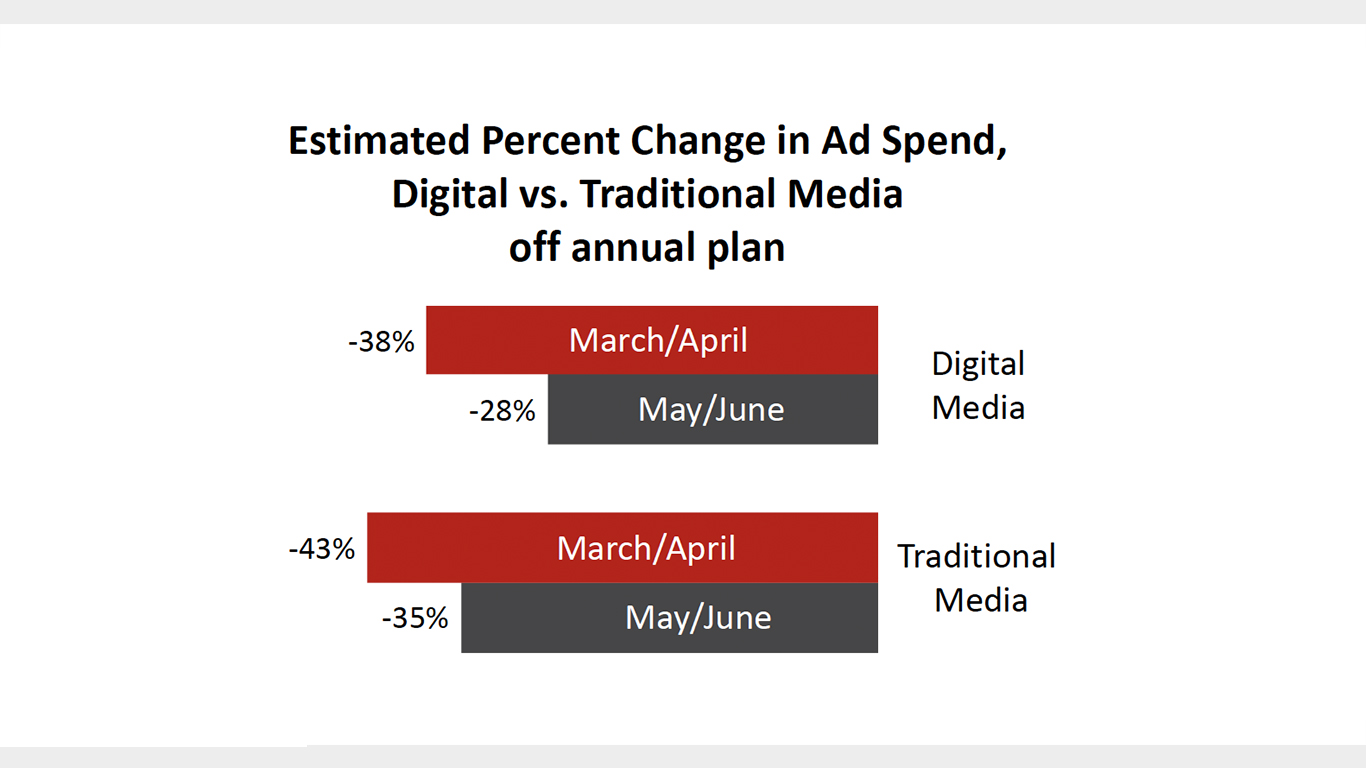

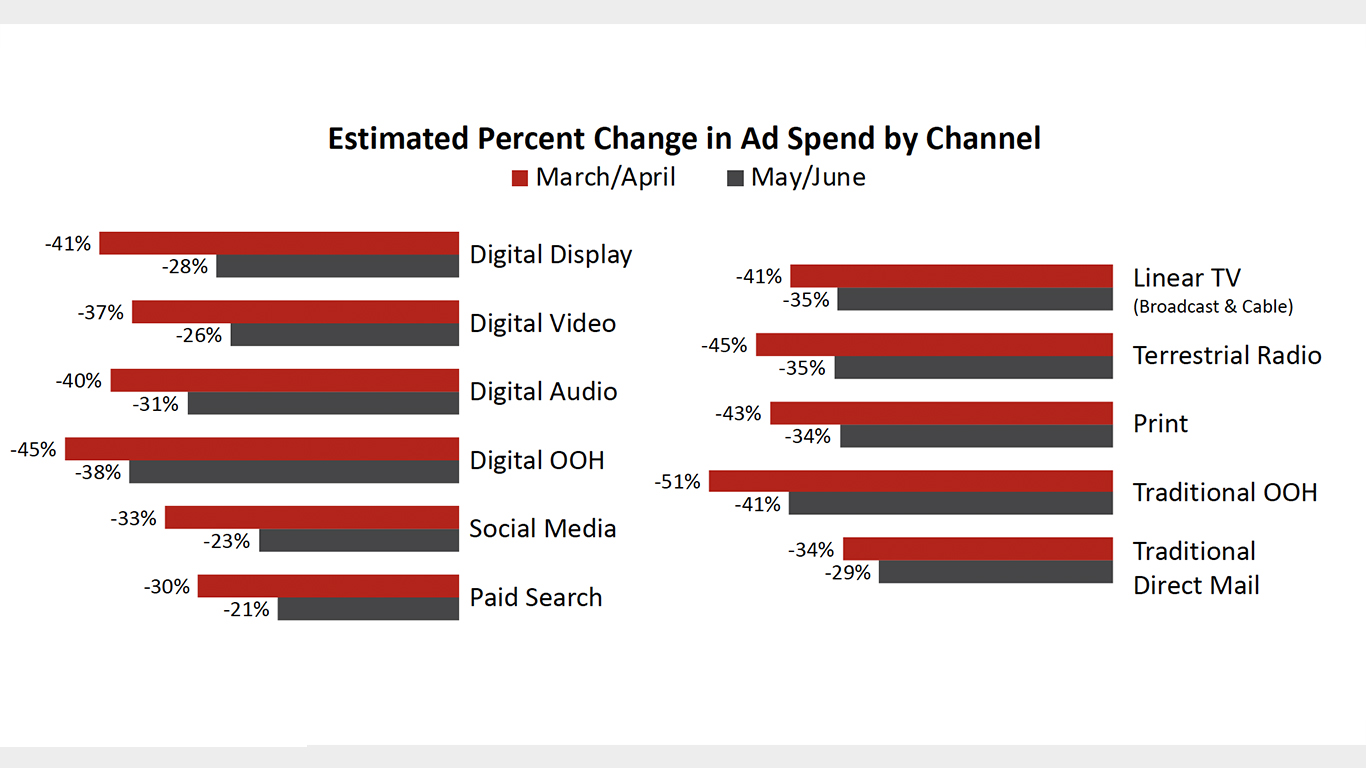

• Expect slightly less negative impact on Digital spend than on Traditional spend for Q1 & Q2, and a faster rebound for digital in Q2

• Impact on Q3 and Q4 spending is expected to be more modest

• 73% of buyers are indicating that the Coronavirus will have an impact on 2020/21 Upfront spend plans

• Expect a 20% decrease in Upfront spend vs original plan

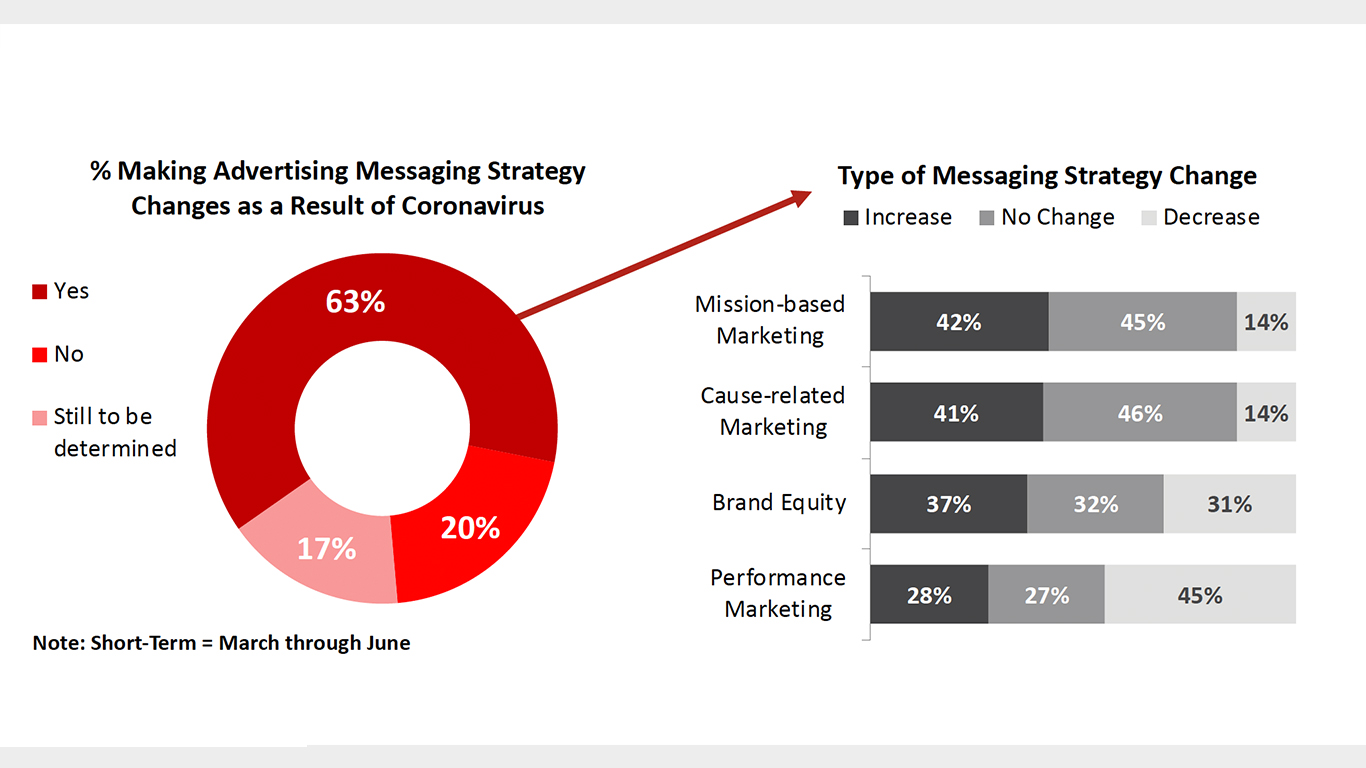

Regarding what is happening right now, digital ad spend is down 33% while traditional ad spend is down 39%. The majority of advertisers are adjusting their messaging and are increasing Mission-Based Marketing by 42% and Cause-Related Marketing by 41%. Obviously the tone of advertising is also rapidly changing.

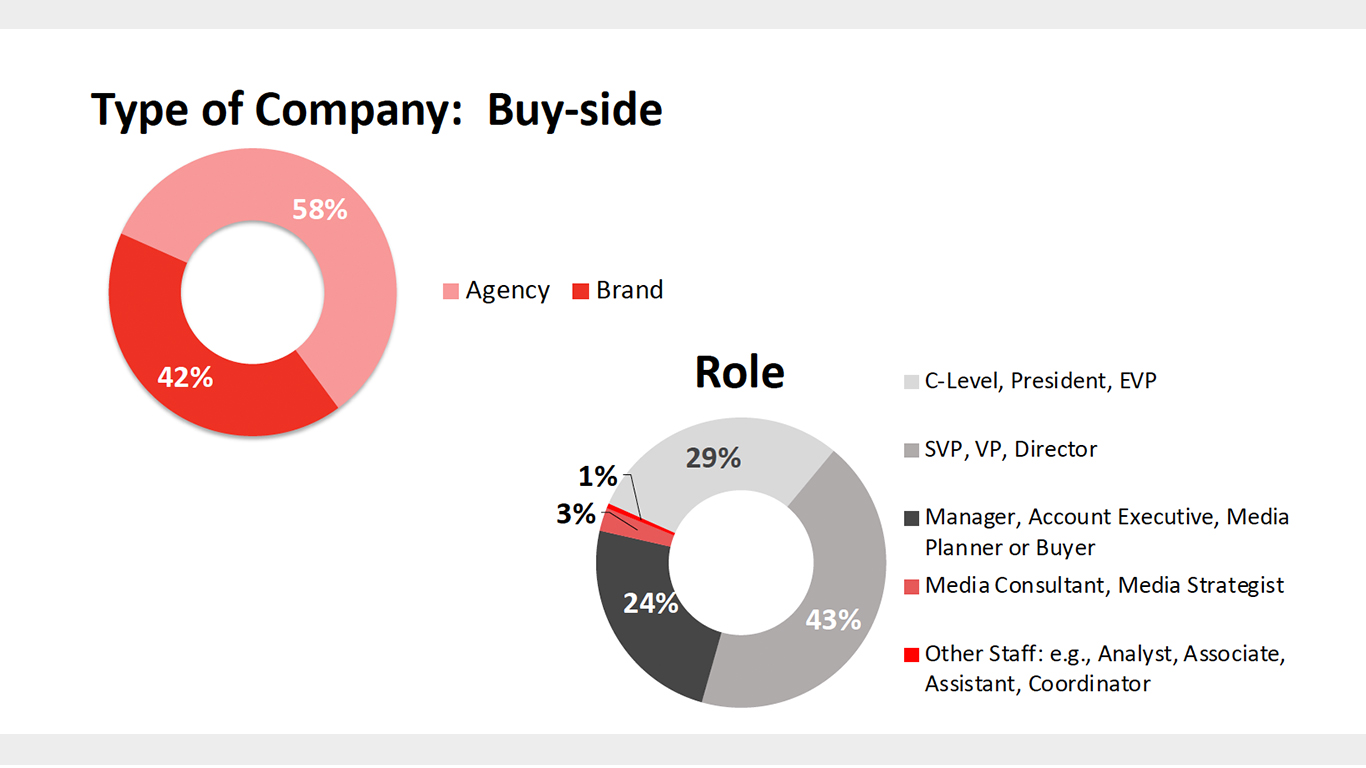

Respondents to this survey were comprised of both agencies and brands which represent a wide spectrum of U.S. advertising categories:

9% Travel & Tourism

8% Health/Healthcare (Non OTC/DTC)

7% Automotive & Related

7% B2B

6% Apparel/Fashion

6% Technology

5% CPG Food/Beverage

5% Financial Services

4% Retail (Brick & Mortar)

4% Education/Government

39% Other

70% of buyers are quickly adjusting or pausing their planned advertising spend between March and June.

Respondents, at least at the moment, believe that their ad reduction will rebound slightly beginning in May.

The above rebound looks to be spread across all channels.

Not just is the volume of ad spending changing, but so is the type of ad messaging. In fact, IAB’s survey shows that the messaging coming from brands has turned 180 degrees away from traditional performance messaging.

In part two, we will look at the current optimism for Q4 spending and the shift in Upfront dollars.